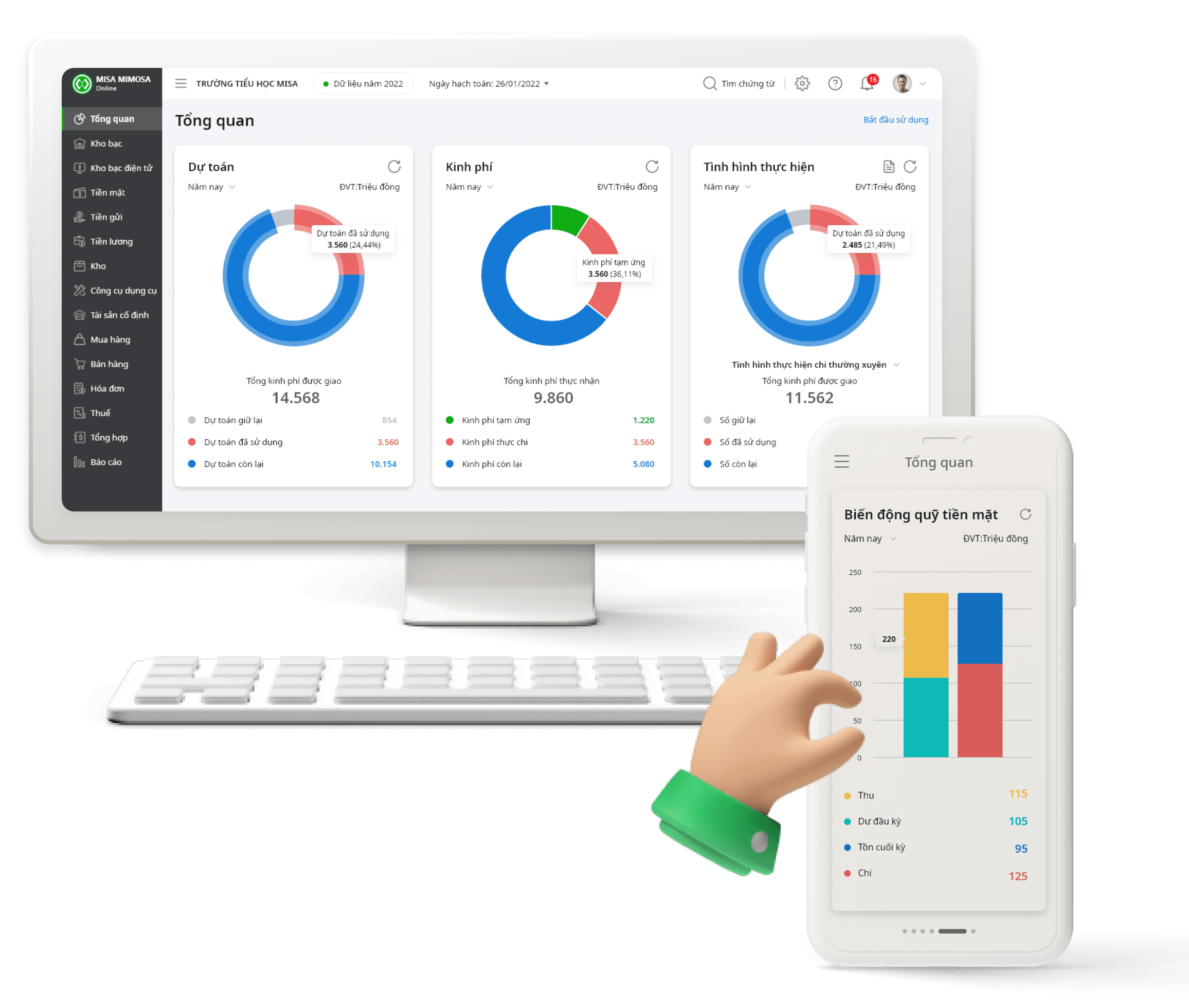

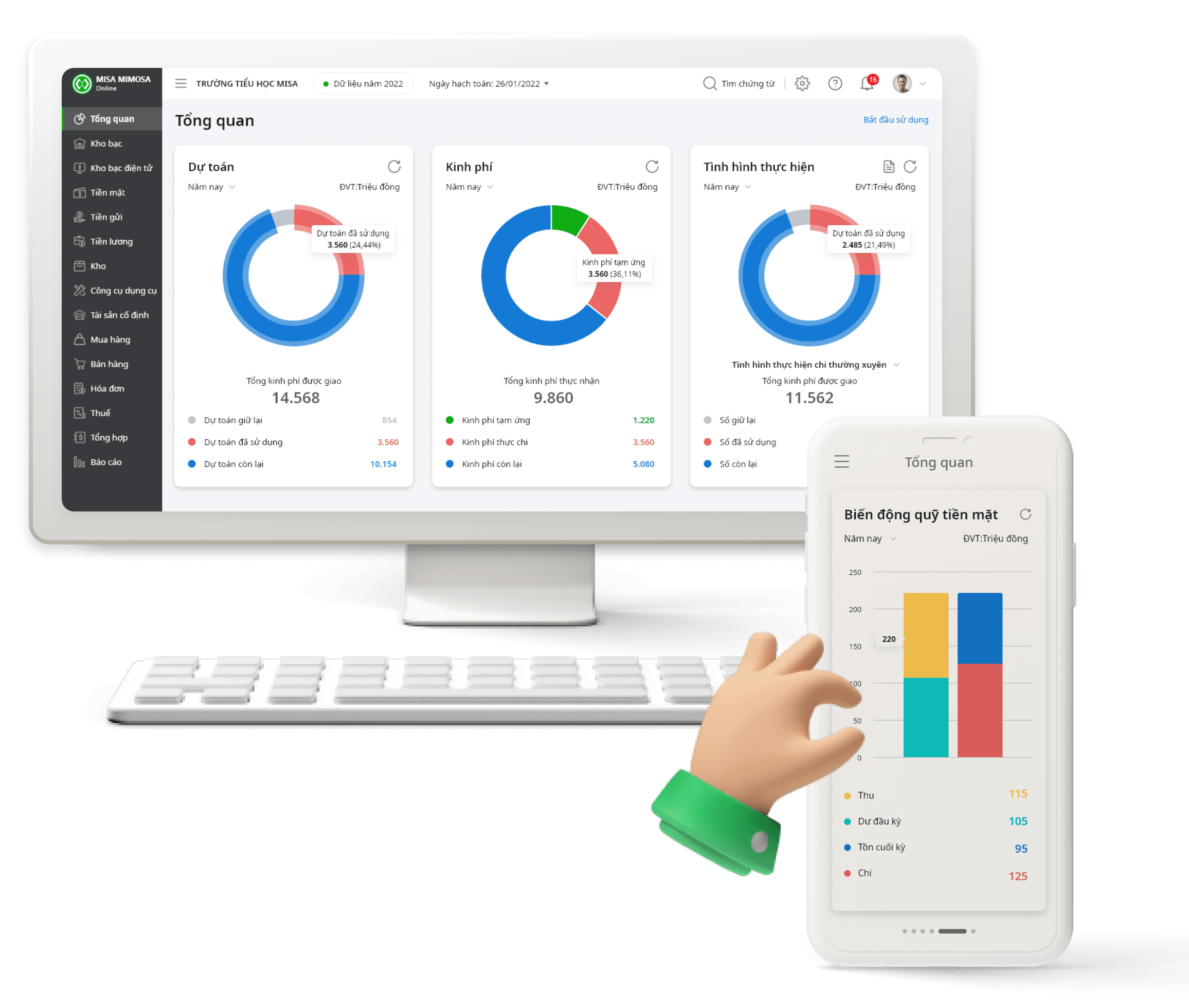

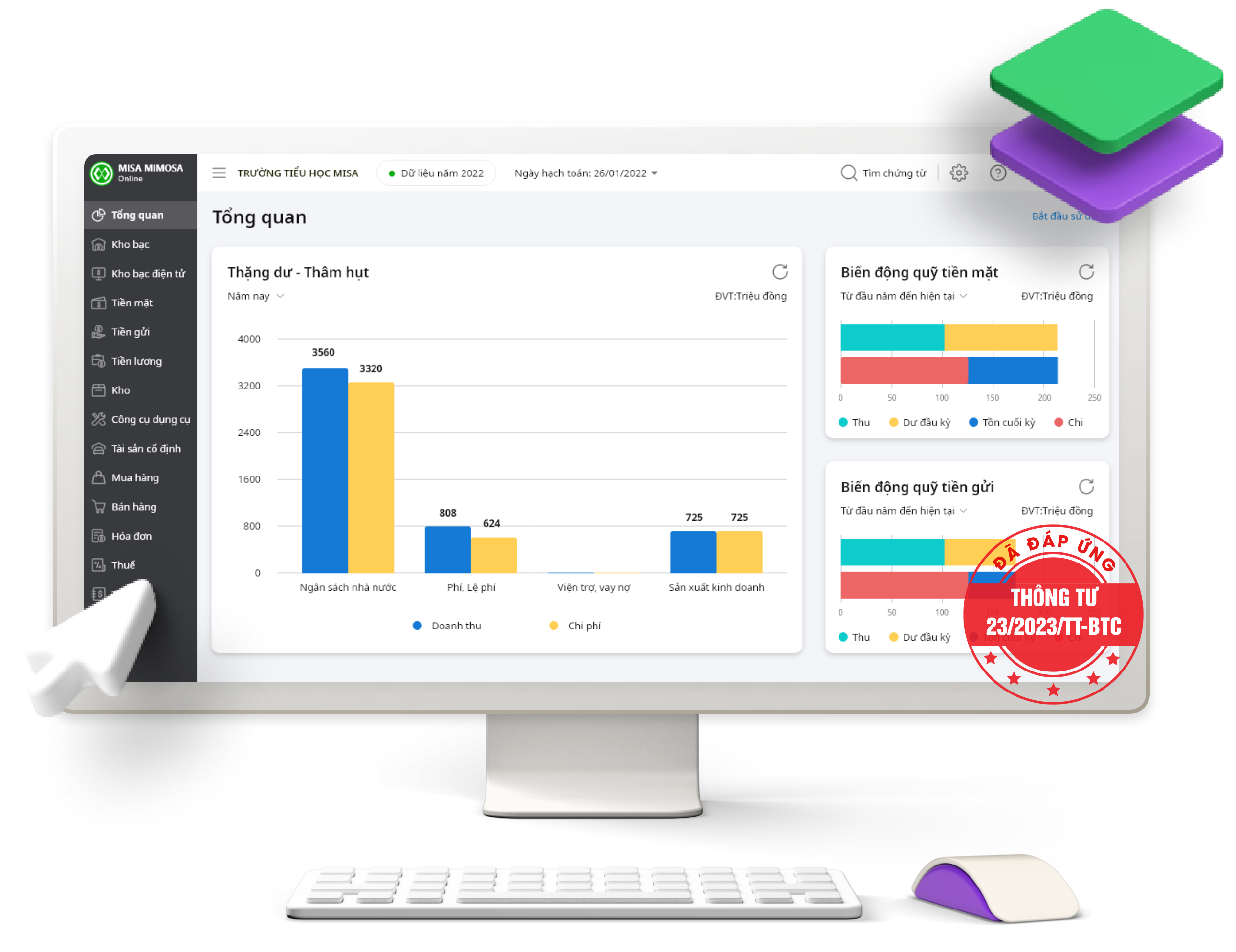

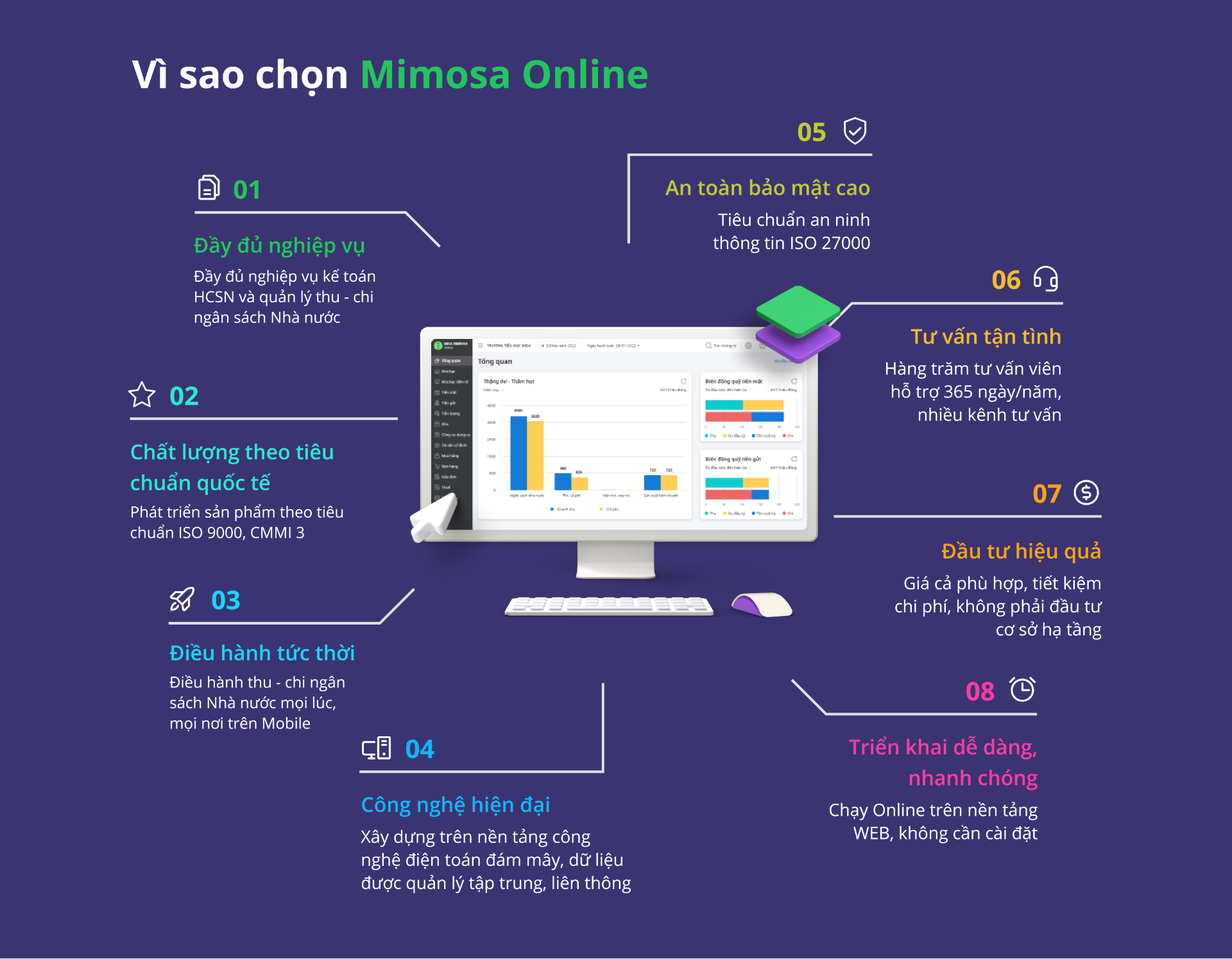

Mimosa Online

Leading Accounting Software for Administrative units, Public service units, Commune/Ward/Special zone People’s Committee

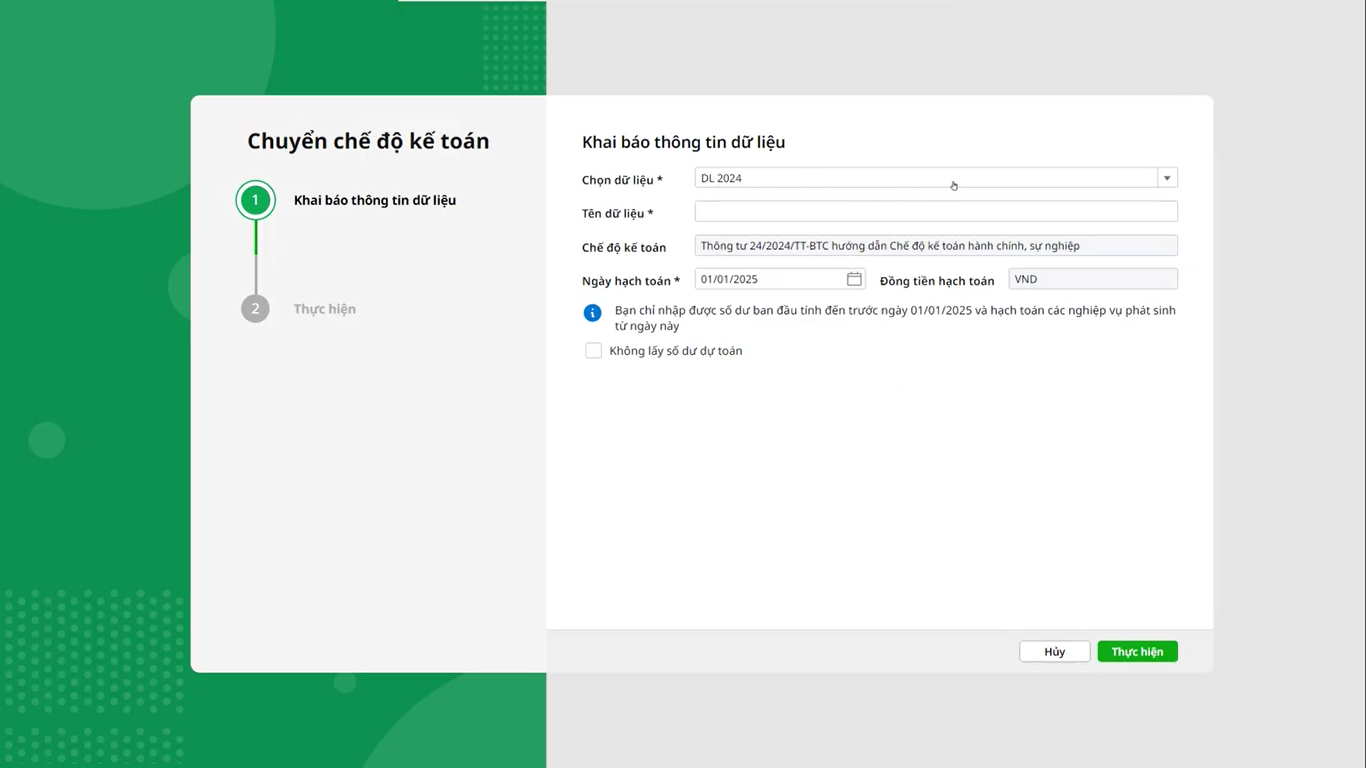

Accounting software suitable for deployment for all

administrative and public service units, from public service units that are self-sufficient or partially self-sufficient

in operating expenses to public service units whose operating expenses are fully covered by

the State Budget

administrative and public service units, from public service units that are self-sufficient or partially self-sufficient

in operating expenses to public service units whose operating expenses are fully covered by

the State Budget

Mimosa Online

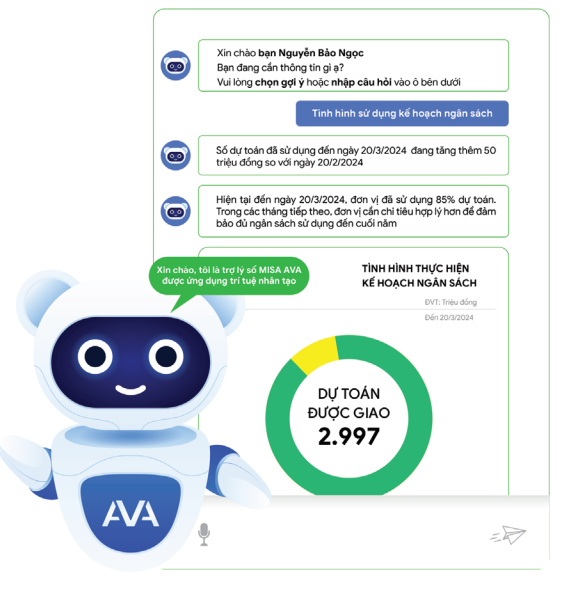

Number 1 Accounting Software

for

Administrative and Public Service Units

Administrative and Public Service Units

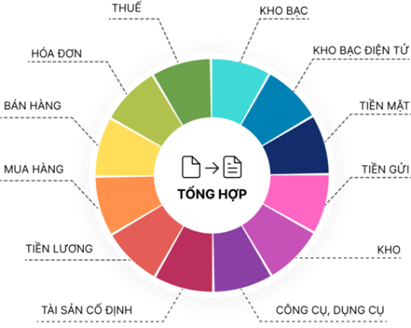

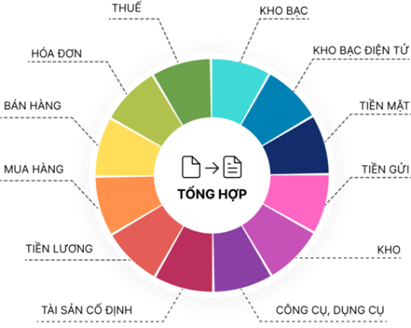

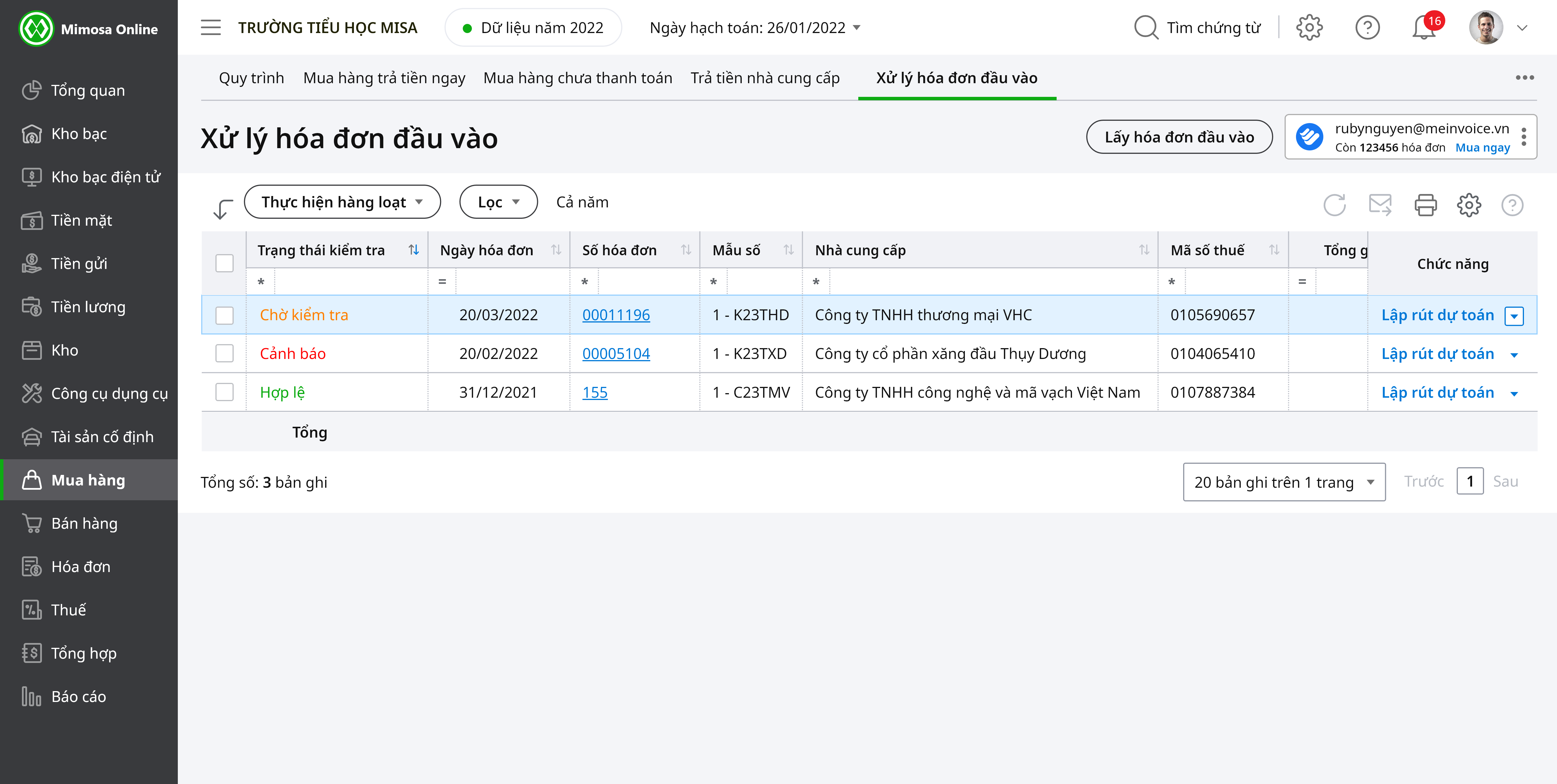

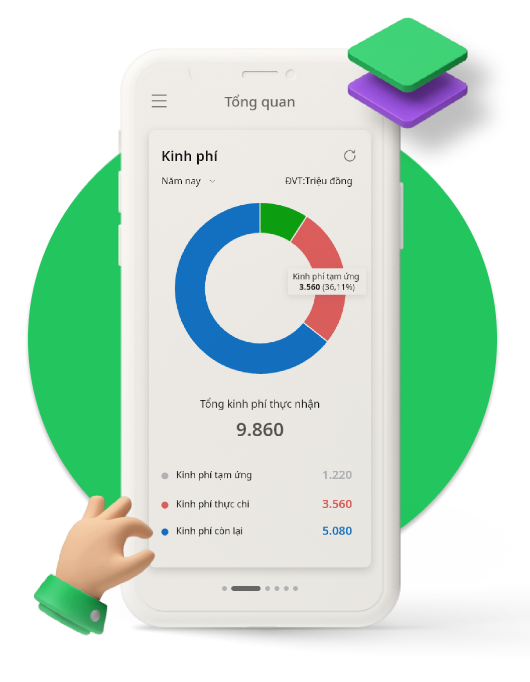

Accounting software that helps administrative and public service units perform operations: Treasury, Cash, Deposits, Goods and materials, Fixed assets, Tools and instruments, Payroll, Purchases, Sales, Invoices, Debts, Taxes, General accounting

024 3795 9595

024 3795 9595 https://www.misa.vn/

https://www.misa.vn/